Pearson product-moment correlation coefficient

In statistics, the Pearson product-moment correlation coefficient (sometimes referred to as the PPMCC or PCCs[1], and typically denoted by r) is a measure of the correlation (linear dependence) between two variables X and Y, giving a value between +1 and −1 inclusive. It is widely used in the sciences as a measure of the strength of linear dependence between two variables. It was developed by Karl Pearson from a similar but slightly different idea introduced by Francis Galton in the 1880s.[2][3] The correlation coefficient is sometimes called "Pearson's r."

Contents |

Definition

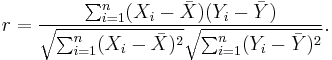

Pearson's correlation coefficient between two variables is defined as the covariance of the two variables divided by the product of their standard deviations:

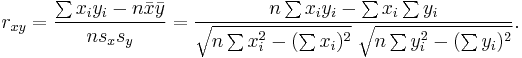

The above formula defines the population correlation coefficient, commonly represented by the Greek letter ρ (rho). Substituting estimates of the covariances and variances based on a sample gives the sample correlation coefficient, commonly denoted r :

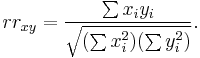

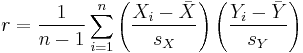

An equivalent expression gives the correlation coefficient as the mean of the products of the standard scores. Based on a sample of paired data (Xi, Yi), the sample Pearson correlation coefficient is

where

are the standard score, sample mean, and sample standard deviation, respectively.

Mathematical properties

The absolute value of both the sample and population Pearson correlation coefficients are less than or equal to 1. Correlations equal to 1 or -1 correspond to data points lying exactly on a line (in the case of the sample correlation), or to a bivariate distribution entirely supported on a line (in the case of the population correlation). The Pearson correlation coefficient is symmetric: corr(X,Y) = corr(Y,X).

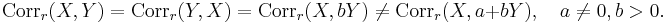

A key mathematical property of the Pearson correlation coefficient is that it is invariant (up to a sign) to separate changes in location and scale in the two variables. That is, we may transform X to a + bX and transform Y to c + dY, where a, b, c, and d are constants, without changing the correlation coefficient (this fact holds for both the population and sample Pearson correlation coefficients). Note that more general linear transformations do change the correlation: see a later section for an application of this.

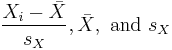

The Pearson correlation can be expressed in terms of uncentered moments. Since μX = E(X), σX2 = E[(X − E(X))2] = E(X2) − E2(X) and likewise for Y, and since

the correlation can also be written as

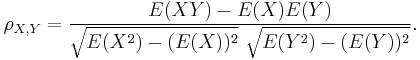

Alternative formulae for the sample Pearson correlation coefficient are also available:

The above formula suggests a convenient single-pass algorithm for calculating sample correlations, but, depending on the numbers involved, it can sometimes be numerically unstable.

Interpretation

The correlation coefficient ranges from −1 to 1. A value of 1 implies that a linear equation describes the relationship between X and Y perfectly, with all data points lying on a line for which Y increases as X increases. A value of −1 implies that all data points lie on a line for which Y decreases as X increases. A value of 0 implies that there is no linear correlation between the variables.

More generally, note that (Xi − X)(Yi − Y) is positive if and only if Xi and Yi lie on the same side of their respective means. Thus the correlation coefficient is positive if Xi and Yi tend to be simultaneously greater than, or simultaneously less than, their respective means. The correlation coefficient is negative if Xi and Yi tend to lie on opposite sides of their respective means.

Geometric interpretation

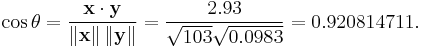

For uncentered data, the correlation coefficient corresponds with the cosine of the angle  between both possible regression lines y=gx(x) and x=gy(y).

between both possible regression lines y=gx(x) and x=gy(y).

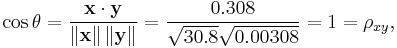

For centered data (i.e., data which have been shifted by the sample mean so as to have an average of zero), the correlation coefficient can also be viewed as the cosine of the angle  between the two vectors of samples drawn from the two random variables (see below).

between the two vectors of samples drawn from the two random variables (see below).

Some practitioners prefer an uncentered (non-Pearson-compliant) correlation coefficient. See the example below for a comparison.

As an example, suppose five countries are found to have gross national products of 1, 2, 3, 5, and 8 billion dollars, respectively. Suppose these same five countries (in the same order) are found to have 11%, 12%, 13%, 15%, and 18% poverty. Then let x and y be ordered 5-element vectors containing the above data: x = (1, 2, 3, 5, 8) and y = (0.11, 0.12, 0.13, 0.15, 0.18).

By the usual procedure for finding the angle  between two vectors (see dot product), the uncentered correlation coefficient is:

between two vectors (see dot product), the uncentered correlation coefficient is:

Note that the above data were deliberately chosen to be perfectly correlated: y = 0.10 + 0.01 x. The Pearson correlation coefficient must therefore be exactly one. Centering the data (shifting x by E(x) = 3.8 and y by E(y) = 0.138) yields x = (−2.8, −1.8, −0.8, 1.2, 4.2) and y = (−0.028, −0.018, −0.008, 0.012, 0.042), from which

as expected.

Interpretation of the size of a correlation

| Correlation | Negative | Positive |

|---|---|---|

| None | −0.09 to 0.0 | 0.0 to 0.09 |

| Small | −0.3 to −0.1 | 0.1 to 0.3 |

| Medium | −0.5 to −0.3 | 0.3 to 0.5 |

| Strong | −1.0 to −0.5 | 0.5 to 1.0 |

Several authors[4][5] have offered guidelines for the interpretation of a correlation coefficient. However, all such criteria are in some ways arbitrary and should not be observed too strictly.[5] The interpretation of a correlation coefficient depends on the context and purposes. A correlation of 0.9 may be very low if one is verifying a physical law using high-quality instruments, but may be regarded as very high in the social sciences where there may be a greater contribution from complicating factors.

Inference

Statistical inference based on Pearson's correlation coefficient often focuses on one of the following two aims. One aim is to test the null hypothesis that the true correlation coefficient ρ is equal to 0, based on the value of the sample correlation coefficient r. The other aim is to construct a confidence interval around r that has a given probability of containing ρ.

Randomization approaches

Permutation tests provide a direct approach to performing hypothesis tests and constructing confidence intervals. A permutation test for Pearson's correlation coefficient involves the following two steps: (i) using the original paired data (xi, yi), randomly redefine the pairs to create a new data set (xi, yi′), where the i′ are a permutation of the set {1,...,n}. The permutation i′ is selected randomly, with equal probabilities placed on all n! possible permutations. This is equivalent to drawing the i′ randomly "without replacement" from the set {1,..., n}. A closely related and equally justified (bootstrapping) approach is to separately draw the i and the i′ "with replacement" from {1,..., n}; (ii) Construct a correlation coefficient r from the randomized data. To perform the permutation test, repeat (i) and (ii) a large number of times. The p-value for the permutation test is one minus the proportion of the r values generated in step (ii) that are larger than the Pearson correlation coefficient that was calculated from the original data. Here "larger" can mean either that the value is larger in magnitude, or larger in signed value, depending on whether a two-sided or one-sided test is desired.

The bootstrap can be used to construct confidence intervals for Pearson's correlation coefficient. In the "non-parametric" bootstrap, n pairs (xi, yi) are resampled "with replacement" from the observed set of n pairs, and the correlation coefficient r is calculated based on the resampled data. This process is repeated a large number of times, and the empirical distribution of the resampled r values are used to approximate the sampling distribution of the statistic. A 95% confidence interval for ρ can be defined as the interval spanning from the 2.5th to the 97.5th percentile of the resampled r values.

Approaches based on mathematical approximations

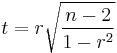

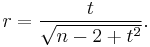

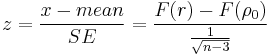

For approximately Gaussian data, the sampling distribution of Pearson's correlation coefficient approximately follows Student's t-distribution with degrees of freedom N − 2. Specifically, if the underlying variables have a bivariate normal distribution, the variable.

has a Student's t-distribution in the null case (zero correlation).[6] This also holds approximately even if the observed values are non-normal, provided sample sizes are not very small.[7] For constructing confidence intervals and performing power analyses, the inverse of this transformation is also needed:

Alternatively, large sample approaches can be used.

Early work on the distribution of the sample correlation coefficient was carried out by R. A. Fisher[8][9] and A. K. Gayen.[10] Another early paper[11] provides graphs and tables for general values of ρ, for small sample sizes, and discusses computational approaches.

Exact distribution for Gaussian data

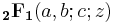

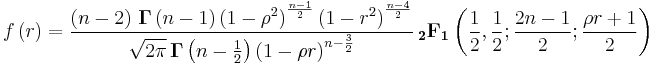

The exact distribution for the sample correlation of a normal bivariate is[12][13]

where  is the Gamma function,

is the Gamma function,  is the Gaussian hypergeometric function.

is the Gaussian hypergeometric function.

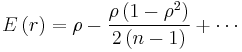

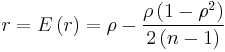

Note that  , therefore r is a biased estimator of

, therefore r is a biased estimator of  . An approximate unbiased estimator can be obtained by solving the equation

. An approximate unbiased estimator can be obtained by solving the equation  for

for  . However, the solution,

. However, the solution, ![\breve{\rho} = r \left[1 %2B \frac{1 - r^2}{2\left(n - 1\right)}\right]](/2012-wikipedia_en_all_nopic_01_2012/I/54905cbd515c2e553bf8eff42d36f479.png) , is suboptimal. An unbiased estimator, with minimum variance for large values of n, with a bias of order

, is suboptimal. An unbiased estimator, with minimum variance for large values of n, with a bias of order  , can be obtained by maximizing

, can be obtained by maximizing  , i.e.

, i.e. ![\hat{\rho} = r \left[1 - \frac{1 - r^2}{2\left(n - 1\right)}\right]](/2012-wikipedia_en_all_nopic_01_2012/I/e82e9da1b00c5ea6a22c8e6c35ed0a22.png) .

.

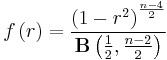

In the special case when  , the distribution can be written as:

, the distribution can be written as:

where  is the Beta function.

is the Beta function.

Fisher Transformation

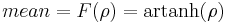

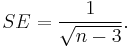

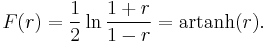

In practice, confidence intervals and hypothesis tests relating to ρ are usually carried out using the Fisher transformation:

If F(r) is the Fisher transformation of r, and n is the sample size, then F(r) approximately follows a normal distribution with

and standard error

and standard error

Thus, a z-score is

under the null hypothesis of that  , given the assumption that the sample pairs are independent and identically distributed and follow a bivariate normal distribution. Thus an approximate p-value can be obtained from a normal probability table. For example, if z = 2.2 is observed and a two-sided p-value is desired to test the null hypothesis that

, given the assumption that the sample pairs are independent and identically distributed and follow a bivariate normal distribution. Thus an approximate p-value can be obtained from a normal probability table. For example, if z = 2.2 is observed and a two-sided p-value is desired to test the null hypothesis that  , the p-value is 2·Φ(−2.2) = 0.028, where Φ is the standard normal cumulative distribution function.

, the p-value is 2·Φ(−2.2) = 0.028, where Φ is the standard normal cumulative distribution function.

Confidence Intervals

To obtain a confidence interval for ρ, we first compute a confidence interval for F( ):

):

The inverse Fisher transformation bring the interval back to the correlation scale.

For example, suppose we observe r = 0.3 with a sample size of n=50, and we wish to obtain a 95% confidence interval for ρ. The transformed value is arctanh(r) = 0.30952, so the confidence interval on the transformed scale is 0.30952 ± 1.96/√47, or (0.023624, 0.595415). Converting back to the correlation scale yields (0.024, 0.534).

Pearson's correlation and least squares regression analysis

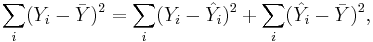

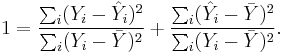

The square of the sample correlation coefficient, which is also known as the coefficient of determination, estimates the fraction of the variance in Y that is explained by X in a simple linear regression. As a starting point, the total variation in the Yi around their average value can be decomposed as follows

where the  are the fitted values from the regression analysis. This can be rearranged to give

are the fitted values from the regression analysis. This can be rearranged to give

The two summands above are the fraction of variance in Y that is explained by X (right) and that is unexplained by X (left).

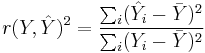

Next, we apply a property of least square regression models, that the sample covariance between  and

and  is zero. Thus, the sample correlation coefficient between the observed and fitted response values in the regression can be written

is zero. Thus, the sample correlation coefficient between the observed and fitted response values in the regression can be written

![\begin{align}

r(Y,\hat{Y}) &= \frac{\sum_i(Y_i-\bar{Y})(\hat{Y}_i-\bar{Y})}{\sqrt{\sum_i(Y_i-\bar{Y})^2\cdot \sum_i(\hat{Y}_i-\bar{Y})^2}}\\

&= \frac{\sum_i(Y_i-\hat{Y}_i%2B\hat{Y}_i-\bar{Y})(\hat{Y}_i-\bar{Y})}{\sqrt{\sum_i(Y_i-\bar{Y})^2\cdot \sum_i(\hat{Y}_i-\bar{Y})^2}}\\

&= \frac{ \sum_i [(Y_i-\hat{Y}_i)(\hat{Y}_i-\bar{Y}) %2B(\hat{Y}_i-\bar{Y})^2 ]}{\sqrt{\sum_i(Y_i-\bar{Y})^2\cdot \sum_i(\hat{Y}_i-\bar{Y})^2}}\\

&= \frac{ \sum_i (\hat{Y}_i-\bar{Y})^2 }{\sqrt{\sum_i(Y_i-\bar{Y})^2\cdot \sum_i(\hat{Y}_i-\bar{Y})^2}}\\

&= \sqrt{\frac{\sum_i(\hat{Y}_i-\bar{Y})^2}{\sum_i(Y_i-\bar{Y})^2}}.

\end{align}](/2012-wikipedia_en_all_nopic_01_2012/I/1e4caa31bf0f23d8efec4fb9cafbf980.png)

Thus

is the proportion of variance in Y explained by a linear function of X.

Sensitivity to the data distribution

Existence

The population Pearson correlation coefficient is defined in terms of moments, and therefore exists for any bivariate probability distribution for which the population covariance is defined and the marginal population variances are defined and are non-zero. Some probability distributions such as the Cauchy distribution have undefined variance and hence ρ is not defined if X or Y follows such a distribution. In some practical applications, such as those involving data suspected to follow a heavy-tailed distribution, this is an important consideration. However, the existence of the correlation coefficient is usually not a concern; for instance, if the range of the distribution is bounded, ρ is always defined.

Large sample properties

In the case of the bivariate normal distribution the population Pearson correlation coefficient characterizes the joint distribution as long as the marginal means and variances are known. For most other bivariate distributions this is not true. Nevertheless, the correlation coefficient is highly informative about the degree of linear dependence between two random quantities regardless of whether their joint distribution is normal.[2] The sample correlation coefficient is the maximum likelihood estimate of the population correlation coefficient for bivariate normal data, and is asymptotically unbiased and efficient, which roughly means that it is impossible to construct a more accurate estimate than the sample correlation coefficient if the data are normal and the sample size is moderate or large. For non-normal populations, the sample correlation coefficient remains approximately unbiased, but may not be efficient. The sample correlation coefficient is a consistent estimator of the population correlation coefficient as long as the sample means, variances, and covariance are consistent (which is guaranteed when the law of large numbers can be applied).

Robustness

Like many commonly used statistics, the sample statistic r is not robust,[14] so its value can be misleading if outliers are present.[15][16] Specifically, the PMCC is neither distributionally robust, nor outlier resistant[14] (see Robust statistics#Definition). Inspection of the scatterplot between X and Y will typically reveal a situation where lack of robustness might be an issue, and in such cases it may be advisable to use a robust measure of association. Note however that while most robust estimators of association measure statistical dependence in some way, they are generally not interpretable on the same scale as the Pearson correlation coefficient.

Statistical inference for Pearson's correlation coefficient is sensitive to the data distribution. Exact tests, and asymptotic tests based on the Fisher transformation can be applied if the data are approximately normally distributed, but may be misleading otherwise. In some situations, the bootstrap can be applied to construct confidence intervals, and permutation tests can be applied to carry out hypothesis tests. These non-parametric approaches may give more meaningful results in some situations where bivariate normality does not hold. However the standard versions of these approaches rely on exchangeability of the data, meaning that there is no ordering or grouping of the data pairs being analyzed that might affect the behavior of the correlation estimate.

A stratified analysis is one way to either accommodate a lack of bivariate normality, or to isolate the correlation resulting from one factor while controlling for another. If W represents cluster membership or another factor that it is desirable to control, we can stratify the data based on the value of W, then calculate a correlation coefficient within each stratum. The stratum-level estimates can then be combined to estimate the overall correlation while controlling for W.[17]

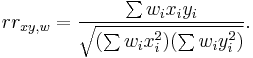

Calculating a weighted correlation

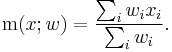

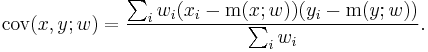

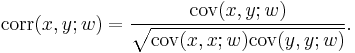

Suppose observations to be correlated have differing degrees of importance that can be expressed with a weight vector w. To calculate the correlation between vectors x and y with the weight vector w (all of length n),[18][19]

- Weighted mean:

- Weighted covariance

- Weighted correlation

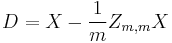

Removing correlation

It is always possible to remove the correlation between random variables with a linear transformation, even if the relationship between the variables is nonlinear. A presentation of this result for population distributions is given by Cox & Hinkley.[20]

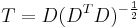

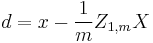

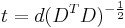

A corresponding result exists for sample correlations, in which the sample correlation is reduced to zero. Suppose a vector of n random variables is sampled m times. Let X be a matrix where  is the jth variable of sample i. Let

is the jth variable of sample i. Let  be an m by m square matrix with every element 1. Then D is the data transformed so every random variable has zero mean, and T is the data transformed so all variables have zero mean and zero correlation with all other variables - the moment matrix of T will be the identity matrix. This has to be further divided by the standard deviation to get unit variance. The transformed variables will be uncorrelated, even though they may not be independent.

be an m by m square matrix with every element 1. Then D is the data transformed so every random variable has zero mean, and T is the data transformed so all variables have zero mean and zero correlation with all other variables - the moment matrix of T will be the identity matrix. This has to be further divided by the standard deviation to get unit variance. The transformed variables will be uncorrelated, even though they may not be independent.

where an exponent of -1/2 represents the matrix square root of the inverse of a matrix. The covariance matrix of T will be the identity matrix. If a new data sample x is a row vector of n elements, then the same transform can be applied to x to get the transformed vectors d and t:

This decorrelation is related to Principal Components Analysis for multivariate data.

Reflective correlation

The reflective correlation is a variant of Pearson's correlation in which the data are not centered around their mean values. The population reflective correlation is

The reflective correlation is symmetric, but it is not invariant under translation:

The sample reflective correlation is

The weighted version of the sample reflective correlation is

See also

- Correlation and dependence

- Spearman's rank correlation coefficient

- Association (statistics)

- Disattenuation

- Maximal information coefficient

References

- ^ "The human disease network", Albert Barabasi et al., Plos.org

- ^ a b J. L. Rodgers and W. A. Nicewander. Thirteen ways to look at the correlation coefficient. The American Statistician, 42(1):59–66, February 1988.

- ^ Stigler, Stephen M. (1989). "Francis Galton's Account of the Invention of Correlation". Statistical Science 4 (2): 73–79. doi:10.1214/ss/1177012580. JSTOR 2245329.

- ^ A. Buda and A.Jarynowski (2010) Life-time of correlations and its applications vol.1, Wydawnictwo Niezalezne: 5–21, December 2010, ISBN 978-83-915272-9-0

- ^ a b Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.)

- ^ N.A Rahman, A Course in Theoretical Statistics; Charles Griffin and Company, 1968

- ^ Kendall, M.G., Stuart, A. (1973)The Advanced Theory of Statistics, Volume 2: Inference and Relationship, Griffin. ISBN 0852642156 (Section 31.19)

- ^ Fisher, R.A. (1915). "Frequency distribution of the values of the correlation coefficient in samples from an indefinitely large population". Biometrika 10 (4): 507–521. doi:10.1093/biomet/10.4.507.

- ^ Fisher, R.A. (1921). "On the probable error of a coefficient of correlation deduced from a small sample" (PDF). Metron 1 (4): 3–32. http://hdl.handle.net/2440/15169. Retrieved 2009-03-25.

- ^ Gayen, A.K. (1951). "The frequency distribution of the product moment correlation coefficient in random samples of any size draw from non-normal universes". Biometrika 38: 219–247. doi:10.1093/biomet/38.1-2.219.

- ^ Soper, H.E., Young, A.W., Cave, B.M., Lee, A., Pearson, K. (1917). "On the distribution of the correlation coefficient in small samples. Appendix II to the papers of "Student" and R. A. Fisher. A co-operative study", Biometrika, 11, 328-413. doi:10.1093/biomet/11.4.328

- ^ Kenney, J. F. and Keeping, E. S., Mathematics of Statistics, Pt. 2, 2nd ed. Princeton, NJ: Van Nostrand, 1951.

- ^ Correlation Coefficient - Bivariate Normal Distribution

- ^ a b Wilcox, Rand R. (2005). Introduction to robust estimation and hypothesis testing. Academic Press.

- ^ Devlin, Susan J; Gnanadesikan, R; Kettenring J.R. (1975). "Robust Estimation and Outlier Detection with Correlation Coefficients". Biometrika 62 (3): 531–545. doi:10.1093/biomet/62.3.531. JSTOR 2335508.

- ^ Huber, Peter. J. (2004). Robust Statistics. Wiley.

- ^ Katz., Mitchell H. (2006) Multivariable Analysis - A Practical Guide for Clinicians. 2nd Edition. Cambridge University Press. ISBN 9780521549851. ISBN 052154985X doi:10.2277/052154985X

- ^ http://sci.tech-archive.net/Archive/sci.stat.math/2006-02/msg00171.html

- ^ A MATLAB Toolbox for computing Weighted Correlation Coefficients

- ^ Cox, D.R., Hinkley, D.V. (1974) Theoretical Statistics, Chapman & Hall (Appendix 3) ISBN 0412124203

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

![\rho_{X,Y}={\mathrm{cov}(X,Y) \over \sigma_X \sigma_Y} ={E[(X-\mu_X)(Y-\mu_Y)] \over \sigma_X\sigma_Y},](/2012-wikipedia_en_all_nopic_01_2012/I/17709e96782a6a8bcd39904c5f2383e6.png)

![E[(X-E(X))(Y-E(Y))]=E(XY)-E(X)E(Y),\,](/2012-wikipedia_en_all_nopic_01_2012/I/d68b84931c79ab42b6a9374ffd5a4179.png)

![(1 - \alpha)% CI: \operatorname{artanh}(\rho) \in [\operatorname{artanh}(r) \pm z_{\alpha/2}SE]](/2012-wikipedia_en_all_nopic_01_2012/I/fbf1aa10e5f9c3c65e704efe255c6073.png)

![(1 - \alpha)% CI: \rho \in [\operatorname{tanh}(\operatorname{artanh}(r) - z_{\alpha/2}SE), \operatorname{tanh}(\operatorname{artanh}(r) %2B z_{\alpha/2}SE)]](/2012-wikipedia_en_all_nopic_01_2012/I/ffd14e0d2828b0d21a9b87be18660dd5.png)

![\text{Corr}_r(X,Y) = \frac{E[XY]}{\sqrt{EX^2\cdot EY^2}}.](/2012-wikipedia_en_all_nopic_01_2012/I/25bb0f867f31f5bfb809beed4a01484a.png)